By Terri Somers

Senior manager, global public relations and StoryLab

New life-changing medicines could be developed for patients up to 34 months faster, and drug developers could reap the benefits of getting to market quicker, if biotech and biopharmaceutical companies work with a single, integrated service provider instead of the multiple suppliers they now outsource to, according to a new study by the Tufts Center for the Study of Drug Development (CSDD) at Tufts University.

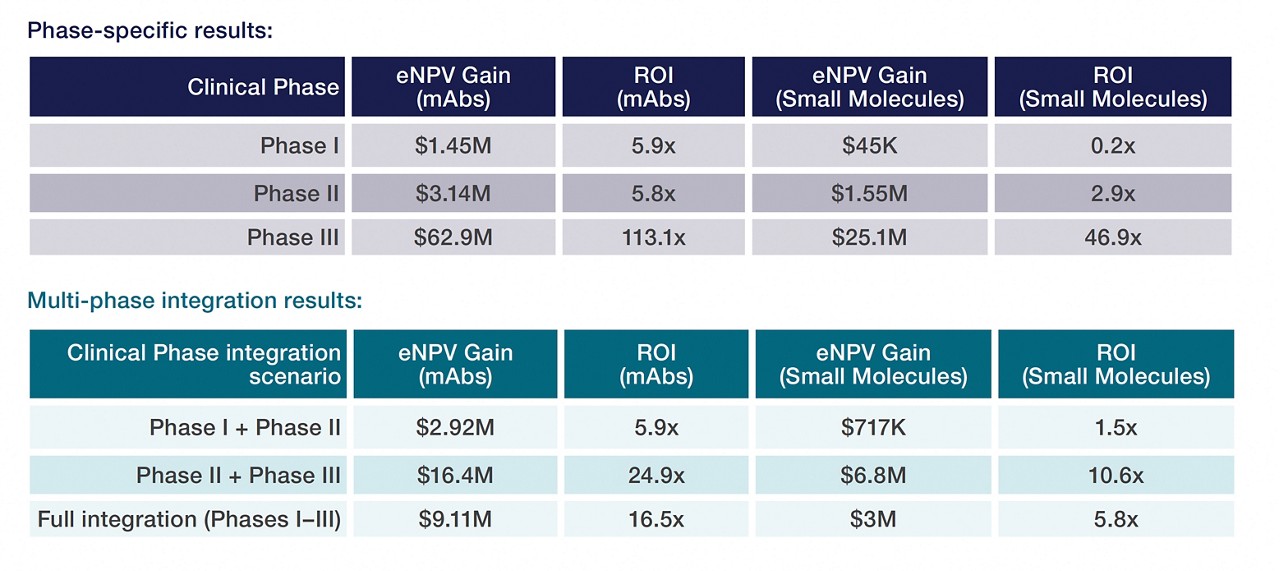

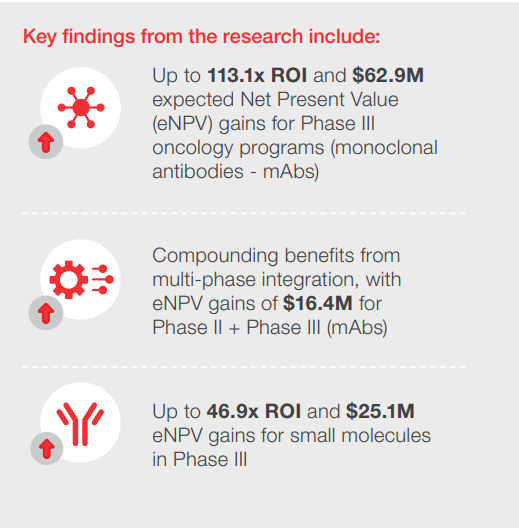

Integration of clinical research organization (CRO) services, clinical supply functions and contract development and manufacturing (CDMO) services with a single vendor yields the most significant financial benefits, according to the study. However, even partial integration offers significant value, particularly in later-stage clinical trial phases when drugs have been somewhat de-risked, the study found.

The more expansive the integration solutions that are adopted, the greater the net financial gain, said authors of the study.

“The findings from this study provide a compelling case for drug sponsors to consider single-vendor, integrated CDMO, CRO and clinical supply solutions as a means of addressing operational inefficiencies,” the report states.

Joseph DiMasi, PhD, director of the independent Economic Development Analysis Center at Tufts

Joseph DiMasi, PhD, director of the independent Economic Development Analysis Center at Tufts

Speed to market is crucial for patients who need treatment options. It’s also important to drug developers who, according to previous studies by CSDD, may invest up to $2.8 billion over a decade or more to develop a new drug, despite facing a 1-in-20 product failure rate and a limited window for market exclusivity, which is when they have the best opportunity to recoup their investment.

“The efficiencies are important to a firm’s profit and loss statements, but more importantly … there will be more projects viewed as financially viable, so we would have an opportunity for more drug development and presumably more innovation to benefit patients,” DiMasi said.

The study focused on the development of oncology drugs, a complex, highly competitive and high-cost sector, with particular emphasis on monoclonal antibodies (mAbs). However, the study notes that the same integration methods can be applied more broadly across other therapeutic areas, suggesting that the qualitative results may be generalizable.

“In biopharma there is always ongoing discussion about when a product will launch and convert the value of its investment into a revenue stream,” said Daniel Burch, M.D., a senior vice president leading global biotech solutions for Thermo Fisher’s clinical research and pharma services businesses. “When Tufts’ paper suggests you can take the average drug development time and potentially shave two to three years off that, it’s a huge value. And the biggest benefit is that our clients can get much-needed medicines to patients earlier, which is the most fulfilling part of this endeavor.”

Outsourcing Prevalence

Drug developers, particularly smaller biotechnology companies with a smaller pipeline of products, often pursue an à la carte approach to outsourcing, securing vendors and services as needed, said Burch, who cited customers that have reported using up to 30 vendors. Companies may take this approach because of limited funding availability, or they may be waiting for a project milestone to proceed, he said.

Identifying Need

Several years ago, Thermo Fisher, with headquarters in Waltham, Mass., had preclinical research and development offerings for clients, as well as commercialization services, but it did not have “that middle chevron of clinical development,” Burch said. In December 2021, Thermo Fisher acquired PPD, a global leader in clinical research, to fill its development services gap.

“Now the world’s leading life science service company has all the relevant resources, and with our global reach, we can offer and assemble these service lines to clients in a comprehensive way,” Burch said. “The natural adjacencies of the services we offer have been able to benefit clients with smoother progression through development, less white space and more visibility into a project, which allows us to apply the right resources at the right time.”

To date, more than 120 biotech and biopharma companies have worked with Thermo Fisher across its integrated CDMO and CRO solutions on more than 350 protocols across therapeutic areas, small molecule, large molecule and advanced therapies.